5 Cheapest Web Hosting for WordPress in 2026

27 July 2023

As a trader who trades stocks in an open market or stock exchange, you may have come across the term OTC several times. If you are reading this blog, then it means you are interested in learning about how OTC trading works in financial markets and trading platforms.

Here are the major areas we will be shedding more light on:

Trading is an attractive option for people who want to buy and sell major stocks and take part in the venture market. With the knowledge gained after reading this article, you can better understand OTC derivatives, market trends on stock prices, and how traditional stock exchanges like the New York Stock Exchange and the Securities and Exchange Commission provide access to OTC markets.

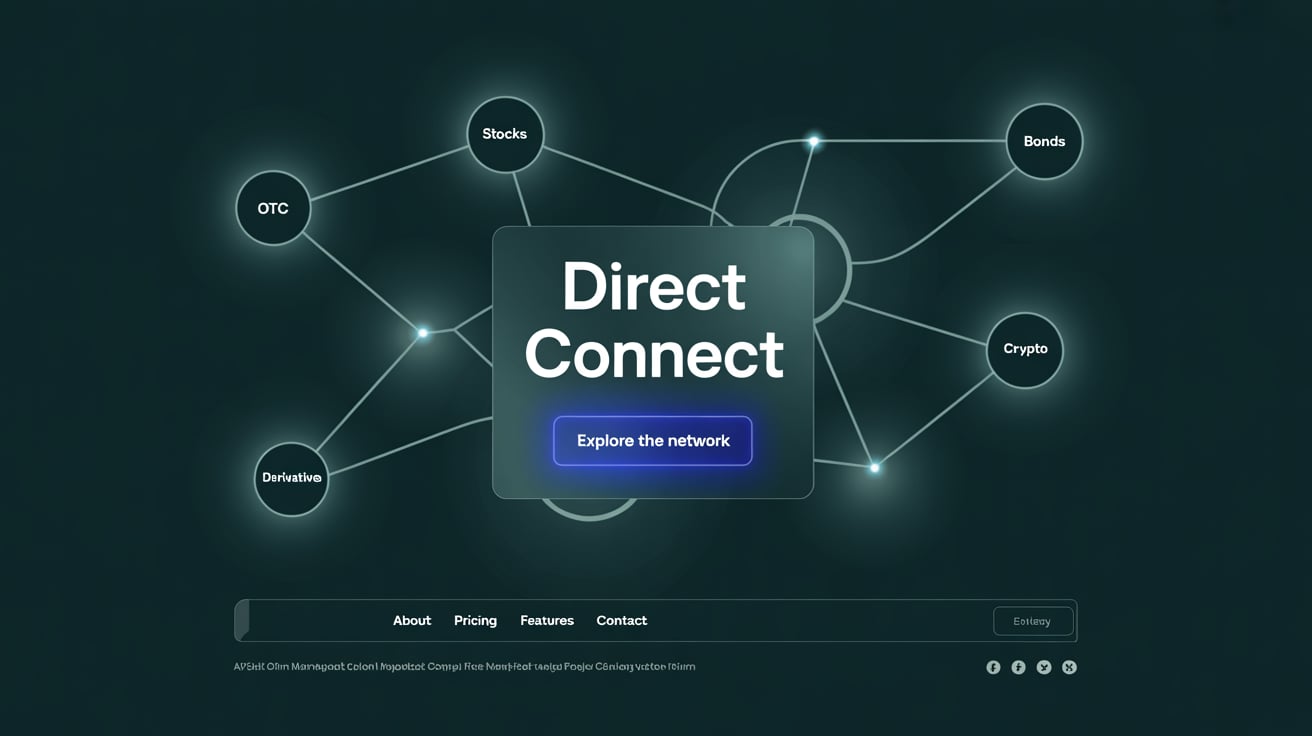

The OTC market is a decentralized market where stocks and other financial instruments can be traded in a pink open market without using any formal exchange. OTC is a term for Over-the-Counter, and it is used when there is a trade between two parties in a customer market via broker-dealer channels.

OTC markets are regulated to promote market transparency when trading takes place. The OTC markets group provides prices in the current market and trading volume for investors considering OTC trading.

1. Decentralized network: OTC trading has become an off-exchange trading that allows electronic OTC transactions between dealers and brokers. Trading over-the-counter does not require central exchanges.

2. Common participants: It is a smaller market that has financial instruments like crypto, bonds, currencies, and derivatives, for trading on current market prices.

There are flexible contracts and conditions for companies via the OTC market. When compared to exchange, OTC trading has lower liquidity and less transparency because there is no centralized body monitoring trading activities.

In exchange trading, there are more regulations, higher liquidity, and transparency because of a structured order book with centralized matching. Traders who engage in futures trading or forex trading can also get access to standardized instruments for gaining market oversight.

| Feature | OTC Trading | Exchange Trading |

| Meaning | Decentralized trading between two parties | Centralized trading |

| Regulation | Limited | Highly regulated |

| Platform | OTC desks and broker networks | Traditional exchanges |

| Transparency | Limited | High |

| Liquidity | Low | High |

| Privacy | High | Low |

| Settlement | Slower | Faster |

| Customization | Flexible | Standardized |

| Accessibility | For large companies or institutional trades | Retail investors and institutional investors |

1. Access to niche markets: One of the benefits offered by OTC markets is access to non-standard, small-cap, or foreign assets for many OTC traders.

2. Contract flexibility: OTC trading allows contract flexibility, such as derivatives, size, and settlement, to prevent retail investors from losing money from electronic quotation and trading.

3. Discreet execution: OTC trading is done for discreet execution, making this trading an attractive option for large orders in crypto to avoid market impact.

4. Alternative access: OTC offers alternative market access for companies that are not prepared for major exchanges to bypass IOS challenges.

1. Lower transparency & liquidity: When companies trade OTC, they make it difficult to confirm information, and prices can swing fast.

2. Potential counterparty/default risk: Since there is less regulation, some retail investor accounts lose money when trading CFDs.

3. Price manipulation & pump‑and‑dump schemes: These schemes are mostly seen in penny stock territory.

4. Regulatory oversight is slower because it is a decentralized market, and traditional exchanges like the SEC have less control over it.

In dealer markets, several dealers quote prices at which they want to sell or buy a security. These dealers are called market makers, and investors can directly trade with them. Examples of such dealers are the OTC Markets Group, like Pink Sheets and OTCBB (Over-the-Counter Bulletin Board)

Dealers in these markets may set ask and bid prices, making prices different for each dealer. This is rampant for foreign equities, penny stocks, and small-cap securities.

These are systems that offer electronic quotes for various OTC securities, allowing real-time price execution and discovery. Note that these trades do not occur on traditional exchanges. Examples of such systems are FINRA's TRACE for bonds, OTC Links ATS, which is controlled by OTC Markets Group, and Bloomberg Terminal OTC data feeds

The electronic quotation systems are transparent, and trades can be done off the platform. It is mostly used by institutions and experts.

Markets like Pink Sheets and OTC Pink are unregulated companies that provide small disclosure requirements. These thinly traded companies have features like low regulation, high risk, and are usually exposed to fraud. Since they have high rewards, they are usually used for penny stocks when both parties trade directly.

Trades are done off-exchange between sellers and buyers by broker-dealers who negotiate terms on the network. Use cases of broker-dealers can be seen in Forex trading, large private stock sales, corporate bonds, and crypto OTC trades. There is no centralized pricing in broker-dealer networks, high flexibility, and perfect for institutional clients.

In the OTC Crypto Market, buyers and sellers use cryptocurrencies for large-volume trades without showing the public order book and slippage. Examples of OTC desks are Genesis Trading, Binance OTC Desk, Circle Trade, and Cumberland. There are custom trade executions and better rates for whale-sized trades in OTC markets.

Trade over the counter are mostly done in the bond market. Bonds are not traded on public exchanges but through dealers. The various types of bonds are municipal, corporate, and treasury bonds. Platforms like TRACE, MarketAxess, and ICAP are commonly used for bond trades.

Contracts that are usually traded with OTC are swaps, forwards, and options. Allowing both parties involved to customize terms and conditions. Examples include currency forwards, interest rate swaps, and credit default swaps (CDS). These type of markets have characteristics like customizable options, counterparty risk, and can be used for hedging or risk management.

| OTC Market Type | Application | Audience |

| Dealer Market | Unlisted equities and penny stocks | Retail and institutions |

| Electronic Quotation Systems | Bond and equity price discovery | Institutions |

| Pink Sheets | Speculative penny stocks | Retail traders and speculators |

| Broker-Dealer Networks | Forex, bonds, crypto, and private equity | Institutions and High clients |

| Fixed Income OTC Market | Corporate or municipal bonds | Institutional investors |

| OTC Crypto Desks | Large trade of BTC or ETH | Funds or crypto whales |

| Derivatives OTC Market | Swaps, structured products, and forwards | Banks and hedge funds |

Over-the-Counter (OTC) trading are found in markets with privacy, customization option, and low liquidity. Here is an overview of different sectors for trading OTC:

OTC trading is suitable for unlisted stocks on major exchanges such as NYSE or NASDAQ. It can be seen in OTC Markets Group like OTCQX best market, Pink Sheets, and OTCQB. Furthermore, they occur in foreign stocks that are unlisted on U.S. exchanges and penny stocks that are less than $5 per share.

Most municipal and corporate bonds trade OTC instead of using centralized exchanges. You can see it on platforms such as TRACE, MarketAxess, and Bloomberg terminal bond listings. Broker-dealers network can also trade bonds.

OTC is found in crypto when institutions or people want to privately trade large volumes without changing the market price. For instance, Binance and Coinbase offer OTC desks. There are also specialized OTC crypto brokers such as Cumberland, Genesis Trading, and FalconX

Another area where OTC is rampant is when customized contracts like swaps, forwards and exotic options are traded. It can also be seen in investment banks and major financial institutions.

Forex is a major OTC market because it functions round the clock without depending on a central exchange. You can find OTC in large banks, electronic communication networks, broker-dealers, and currency exchanges for foreign businesses.

Although most commodities such as gold and oil are traded on futures exchanges, some forward contracts and commodity derivatives use OTC. Examples include private commodity trading desks and companies in the energy or agricultural sector using OTC for hedging.

These investments are not found on public exchanges because they are strictly known as OTC. You can find them in direct equity deals and startups raising capitals via private placement.

Go for credible brokers that are fully adhering to the standards of SEC or FINRA

Do your research to gain information on disclosures, financials, and management.

Wisely evaluate your position before execution by considering areas like limited liquidity Pick trustworthy brokers

Implement the correct structured contracts for forwards or derivatives

Here is a high-value YouTube video to reinforce what you’ve learned on OTC market cap.

What is the OTC Market? Clear breakdown of OTCQX, OTCQB, and Pink Sheets tiers—great for understanding where each fits in the OTC ecosystem

In conclusion, OTC stands for Over‑the‑Counter, a market mechanism that enables direct, flexible trading beyond centralized exchanges. This flexibility offers access to unique investment vehicles like microcaps, bonds, bespoke derivatives, and crypto. Through this guide, the concept of OTC, its pros, its pitfalls, and best practices are now clear, empowering you to approach OTC markets with confidence or choose traditional exchanges when appropriate.

You can also check out this blog to learn how to spot a bull run

It’s riskier than exchange trading due to less transparency and weaker regulation.

Yes, some blue-chip companies used OTC for strategic reasons or before listing

The least regulated tier of OTC markets is home to speculative or unregulated firms.

Yes, OTC desks let big players negotiate crypto outside public order books.